1.9 Trillion Reasons To Invest in Cryptocurrencies #6

If you need more background on the current state of monetary supply worldwide, check out my previous article about this topic.

With the passage of the next US stimulus coming any day, Let’s look at a breakdown of the funds.

Since March 2020, we have printed 4.507 trillion dollars. This amount of money is beyond comprehension, but let’s attempt to understand it. If we split the COVID-19 stimulus spending into a yearly salary, you would be printing 514.5 Million dollars per hour. It sounds like unsustainable spending to me, considering America’s GDP has been stagnant, and government spending is higher than collected revenue for over a decade.

This has led to a bill of 28 Trillion by our government, funded solely by its constituents. That equals 84,681 USD per American citizen. Here are 3,200 dollars, and by the way, you now owe only 81,481 USD. Thanks for the reckless spending, guys.

While we let that sink in, the economy hit the highest unemployment rates since the great depression, and this was not only in America. Most countries are far above their normal unemployment rates, such as UK, Canada, and India. This massive spike in unemployment leads to people trying to recover and save, which reduces money velocity.

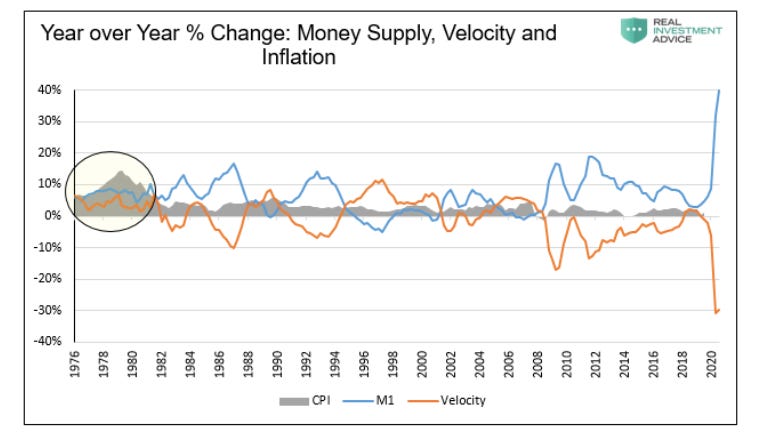

Money velocity measures people’s willingness to hold cash or how often cash turns over. Higher velocity means people are spending cash on goods and services. Lower velocity means that people hoard cash, usually during periods of economic weakness, credit stress, and fear. We are currently at unprecedented levels of inflation, and money velocity is slowing down rapidly.

This leads to economic stagnation and rising CPI (consumer price index). In the late ’70s, America had a severe CPI increase after removing the US from the gold standard by Nixon, which inflated the supply of money. As history seems to repeat itself, these factors contribute to higher inflation, eroding your savings over time. If you didn’t make 40% returns on your investment portfolio last year, you lost money due to the monetary supply increase. But enough of the doom and gloom, let’s get to the light at the end of the tunnel.

Invest

With a family of four receiving 5,600 USD, it is time to protect your wealth. There are many different options on this front.

Stocks and commodities are a great place to start, especially in a rapidly inflating supply of USD. The markets will see enormous growth, but these vehicles are still tied to the underlying value of the dollar. When the economy's stagnation finally catches up, the profit from stocks will still be paid in a government-backed currency instead of an asset without government interference. While no plan to raise interest rates is on the docket, the rate hike will cripple profits gained over this period of expansion.

Property is also another great investment opportunity as that is a scarce resource. We aren’t creating more land any time soon, and people always need a place to live. This is definitely a great investment for a long-term outlook, especially for rental properties, but property investments are very illiquid. If needing access to your funds is a priority, selling and buying property usually takes upwards of 3 months to finalize.

Precious metals are another option, and it has the benefit of no government control over the supply. Gold has been a great store of value since the dawn of civilization and will continue to hold value against global monetary increases. On the other hand, it is no longer the only hedge against inflation. If cryptocurrency were not invented, it would have seen a lot more growth over the last year. While I think it has not reached its market potential, it has lost its luster to the younger generation of investors.

As Warren Buffet always said gold “gets dug out of the ground in Africa… Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

This leaves us with cryptocurrencies. The new wave of young investors is looking at something new and like what they see. It has the potential to eat away at the 9 trillion dollar gold market slowly, as well as to have an actually limited supply. No entity can fudge the numbers, so to speak, and that is where the potential lies.

The choice is up to you on which investments you want to follow through on, but if you leave your money in savings, 40% of it is on fire. So, if there is anything to take away from this article, it is to invest in something.

While most mainstream investment advisors finally suggest allocating 3% of your investment portfolio into cryptocurrencies, there is evidence with the gaining popularity of digital assets and incoming destabilization of the dollar, 10% of your investment portfolio is safely within risk and reward potential. If this money is not a dire necessity, spending between 168-560 USD of your stimulus on cryptocurrency can help hedge the upcoming uncertainties of the market. This jumpstart of funds plus my recommended dollar-cost averaging investment strategy can help protect from inflation while minimizing risk and potential for a large upside.

This week’s news is looking excellent—lots of new companies are getting exposure.

Norway-Listed Aker to Put 100% Bitcoin in Treasury Reserves of New Investment Unit 👍

Oslo stock exchange-listed Aker ASA has set up a new company dedicated to investing in bitcoin projects and companies. In an announcement Monday, the holding company focused on energy, construction and fishing said its new entity, Seetee AS, will keep all its liquid investable assets in bitcoin and will also enter the bitcoin mining industry. Read more.

JPMorgan Sends Its Private Clients a Primer on Crypto 👀

JPMorgan has sent a report to its private banking clients to educate them on the risks and opportunities of investing in crypto. The report, which was produced in February 2021 and obtained by CoinDesk Friday, has been distributed to clients of JPMorgan Private Bank, which requires a minimum balance of $10 million to open an account. Read more.

Bitcoin’s 2021 Returns Destroy Everything on Wall Street, Goldman Sachs Says 🐂

Goldman Sachs, the storied Wall Street firm, didn’t start including bitcoin (BTC, +4.39%) in its weekly ranking of global asset-class returns until late January, when the largest cryptocurrency quietly appeared atop the chart.

But since then, bitcoin’s lead over assets from stocks to bonds, oil, banks, gold and tech stocks and the euro has widened.

As of March 4, bitcoin’s year-to-date return, at about 70%, was roughly double that for the next-closest competitor, the energy sector, at about 35%, according to Goldman Sachs’ latest “U.S. Weekly Kickstart” report.

The comparisons could become even more flattering to bitcoin now that a recent bout of selling in U.S. stocks has taken the Standard & Poor’s 500 Index’s year-to-date return to roughly zero – flat on the year. Read more.

US Lawmakers Introduce Bill to Clarify Crypto Regulations ✔️

Congress may soon try to clarify digital asset regulation in the U.S.

Reps. Patrick McHenry (R-N.C.) and Stephen Lynch (D-Mass.) introduced legislation Tuesday to create a working group composed of industry experts and representatives from the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) to evaluate the current legal and regulatory framework around digital assets in the U.S. Read more.

That’s all for the free weekly Crypto Crier. If you enjoyed this article, please like and share. If you have any questions, please leave a comment, and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your own research on all financial endeavors. I hope that these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without middlemen.

Let’s build something together.

Tell your friends and family. This is targeted at entry-level education for possible crypto investors. With more people understanding digital assets, we can finally progress to better. 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter, which includes daily analysis of my top picks and setups for entry/exit positions—all of these extras for the price of taking me to lunch.