Bitcoin ETF Approved, but what about Ethereum?

First of all, I am moved in and back on the grind. Congratulations to Donald Reifer for winning the NFT giveaway from last week. I plan to continue to do these giveaways to get people interested in NFTs, so be on the lookout.

With the news of ProShares BTC ETF approved for NYSE starting October 19th, 2021, and 993 million dollars in natural volume traded on the first day, I would like to congratulate all of the people who have been a part of the cryptocurrency community. Due to the conviction of all of us, we usher in a new asset class that can forever reshape the way money is handled. Make these institutions buy our crypto bags!

Enough of the back pats and high fives; let’s get down to business. For those of you who don’t know, an ETF or exchange-traded fund is a type of security that tracks an index, commodity, or other assets. In this case, it follows a currency like bitcoin and is traded similarly to how stocks trade. The ability to exchange a paper version of Bitcoin gives traditional finance investors something they are more comfortable with and is the trojan horse into more mainstream adoption.

My primary purpose of bringing this up is that now that Bitcoin is trading on NYSE, we will see more growth in cryptocurrencies over the next few years. Here is why:

The New York Stock Exchange is the largest globally, with an equity market capitalization of over 26.6 trillion U.S. dollars as of July 2021. The green light from the SEC in the form of Bitcoin ETF approval allows market participants to move stock profits to BITO for exposure and keep them contained in the stock market. One of the past issues has been that people deeply engrained in Traditional finance had to jump through hoops to pull liquidity from reserves and get them into cryptocurrency on a new platform. With eliminating the barrier, data has shown that institutional investors expect 1-3% allocation to bitcoin for conservative funds and hedge funds allocating 7-10% over the next five years.

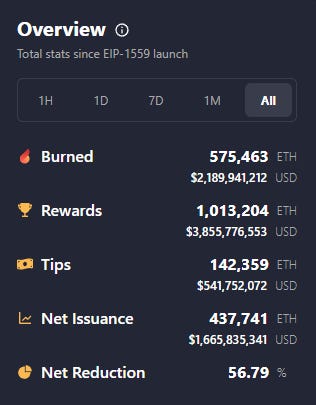

The approval of Bitcoin also sets the precedent that other cryptocurrencies can launch ETFs. Purchasing Ethereum on downtrends now through the inevitable acceptance of an ETH ETF will reduce risk exposure. Ethereum is also currently issuing 56% less currency due to EIP-1559, and .5% of the total supply has been burned since its launch in August.

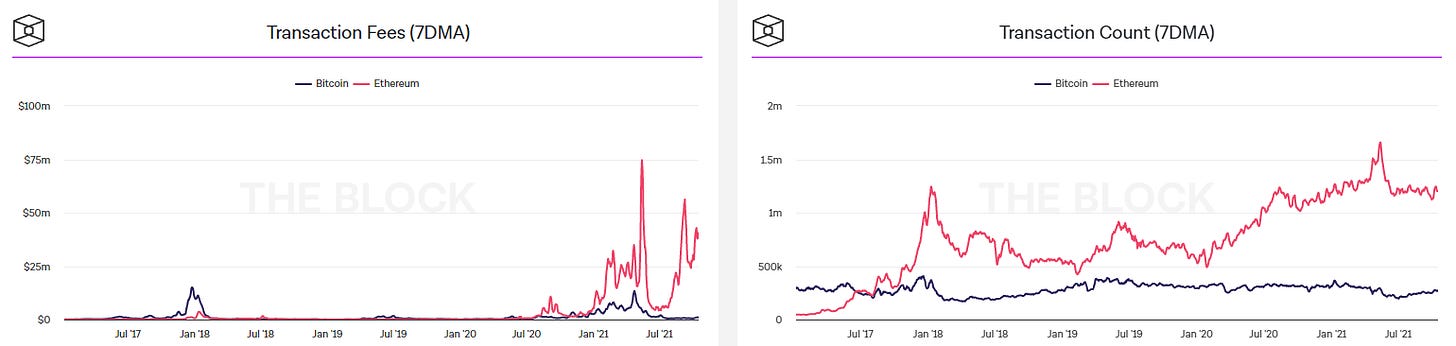

Ethereum is quickly becoming the most demanded blockspace as well. Each block in a blockchain has a fee based on current demand. Ethereum blocks are in extremely high demand accruing 40x higher gas fees than BTC with roughly 5x the transactions.

So, While Bitcoin is the most crowded trade in the room, looking for solid entries on Ethereum is a great idea. This is especially true when shifting from Bitcoin to Ethereum. The chart below shows the dominance of Bitcoin compared to the rest of the ecosystem.

As the price of Bitcoin rises, you have more substantial purchasing power against most altcoin positions. Looking for a quick rise, such as the rush in BTC currently, can signal a movement into alts and cause a rapid drop in dominance similar to the market in 2017-2018. Either way, cryptocurrencies are here to stay and ETF approval in the short term may stop investors from buy spot BTC, but overall long term we can show them the light.

That’s all for the free weekly Crypto Crier. If you enjoyed this article, please like and share. If you have any questions, please leave a comment, and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your own research on all financial endeavors. I hope these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without middlemen.

Let’s build something together.

Tell your friends and family. This newsletter is targeting entry-level education for possible crypto investors. With more people understanding digital assets, we can finally progress to better systems. 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter, which includes daily analysis of my top picks and setups for entry/exit positions—all of these extras for the price of taking me to lunch.