Layer 1s- The Backbone of Crypto

Introduction

Decisions, decisions, decisions. Choosing a blockchain is kinda like choosing an outfit for a fancy occasion. Does this belt match my shoes? Do my tie and pocket square go together? Did this go out of style in 2021? Much as there is an outfit for every occasion, there is a blockchain for every use. Similar to a bad outfit, being on the wrong chain at the wrong time can leave you standing out in a crowd for all the wrong reasons.

When it comes to blockchains, a term you will hear us use a lot is Layer 1. In simple terms, a Layer 1 blockchain is the base network and its associated infrastructure. Each of these also has its own native token used to pay transaction fees on the network. Eth for Ethereum, BTC for Bitcoin, etc.

So why is layer 1 important? Ethereum was the first smart contract layer 1. It has gained popularity with developers since it has been around the longest. BUT with the development of Proof of Stake consensus mechanisms, many smart contract platforms have been developed to try and compete with Ethereum. A few major players in this space are Avalanche, Solana, Binance chain, Algorand, Cosmos, Cardano, and Harmony. Each of these chains offers a currently improved transaction speed. The question is, can they gain traction faster than Ethereum can convert to proof of stake?

Is 2 better than 1?

By contrast, what is a layer 2? What role do they play? A Layer 1 refers to the base layer of a smart contract blockchain. Blockchains function in different layers to allow more throughput. This is similar to lanes on a highway. More lanes, more throughput.

The main goal of layer 2’s is to batch transactions. This allows more data to be written on the blockchain. The best way to think about this is a whole series of small transactions being processed together. Many Layer 2 protocols are dedicated to Ethereum as it has the longest track record and the most need for Layer 2 scaling solutions due to the least throughput.

With all of that said, one of the most famous layer 2 solutions is Bitcoin’s Lightning Network. This is the solution being used to process everyday payments in El Salvador. The country recently made headlines when it named BTC legal tender.

Opening thoughts

Canuck- I am a big believer in custody and control. Layer 1 blockchains are in control of their own destiny. This offers me, the investor, control over the assets I own on the chain (such as the coin). Though many chains are at the mercy of bridges to some degree, they are responsible for their own success. This to me is the most critical factor.

Crier- I am accused of being an Ethereum Maxi, but I dabble on other Layer 1 competitors. The investor who is not testing the competition is not able to make sound decisions. I also believe, similar to Canuck, that each of these systems has a functioning ecosystem. Just as there are many ISPs (internet service providers), blockchain technology isn’t going to be a monopoly.

Can a project survive if it is not a layer 1?

Crier- I definitely think they can survive and thrive, but only if they are on a long-term successful layer 1. We are seeing this happen on solid projects. Even those with good teams are affected by the activity and shortcomings of the Layer 1 on which it resides.

A good example is Defi Kingdoms (DFK) on the Harmony chain. The Harmony chain was recently attacked. Its bridge was drained of over 100 million dollars. The sad thing is that most of this money was coming from DFK. The game was holding over 90% of the Total value on Harmony. Subsequently, the jewel token price has fallen drastically. This was a problem with the Layer 1 and the overall market sentiment. The consequences however are the treasury of the game studio is affected due to this exploit. Even if a project has a promising outlook, it could be impacted by the chain they have chosen to operate on.

Canuck- In the long run, the simple answer is yes. Some projects that are not layer 1s will survive and thrive. However, I believe the % of total projects relying on someone else’s infrastructure to survive will not be particularly high. As an investor, my life will become more complicated. A much higher level of due diligence will be required to pick which projects are worth betting on.

To me, everything comes down to control. A project should aim to have control over its destiny. Being at the mercy of another company’s developers is a tough spot to be in. A close-to-home example happened recently, our national email payment network in Canada, Interac went down for a whole day. This was because of an outage of the cellular provider Rogers. Interac’s entire business was shut down for 24 hours all across Canada because of the incompetence of another company’s network.

Interac was powerless to do anything until Rogers got their network back up and running. A tough spot to be in for sure. In this example, think of Rogers as a layer 1 and Interac as an app built upon it.

Legal Tender

Canuck- Seeing El Salvador choose to make BTC legal tender and utilize the lightning network was cool to see. However, I don’t think it really moved the needle. We have seen a few examples, such as the Dallas Mavericks accepting DogeCoin. Additionally, Ape Coin is accepted for merchandise payment and a variety of subscription services. A topic I covered here.

The success criteria to me will come down to a few core items: Transaction Speed, Transaction Cost, Price Stability of the token, and Security. I don’t think we are too far off any of the core chains being able to deliver these 4 things. The smart contract chain that figures it out first will have a huge advantage in my opinion. The first one I see being accepted at Starbucks or Amazon will have me super bullish.

Crier- Definitely agree on the key necessities of a viable legal tender substitute; speed, cost, security, and stability are extremely necessary, but I do think that this is something quite far in the future. I think the El Salvador move will end up being more successful than people give credit. They are laying the foundation for lightning network transactions in countries that were forced to use the US dollar after hyperinflation ravaged their domestic currency. You currently only have one choice, and that is to become a vassal state of the IMF, but with El Salvador spearheading this movement, I think other affected countries will follow suit within the next few years.

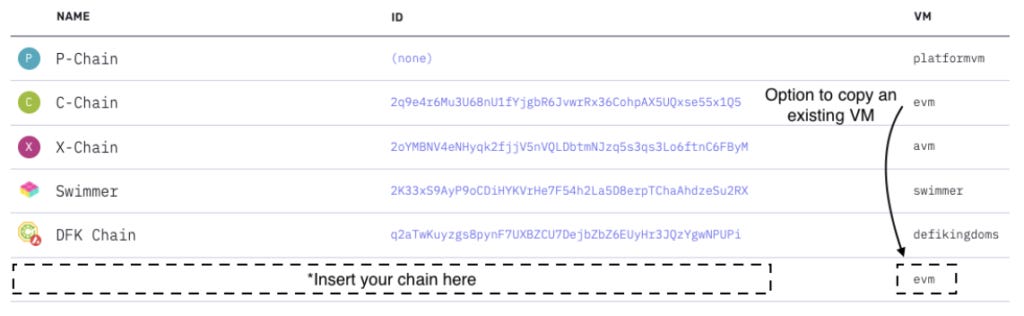

Are subnets a viable solution?

This topic can get quite technical in a hurry. If you would like a quick primer on Subnets, go here.

Crier- On this front, I do think subnets are valuable, especially in the gaming sector. The need to have higher throughput for the much higher transaction count, as most blockchain applications have far fewer transactions, allows the application to be isolated from the main chain. I do think that this will eat into the underlying token price as most subnets are using a different native token as the gas token. So while this is better use, and we have seen the success of a few avalanche subnet applications, it is tough to see where pricing will lead.

Canuck- To me, this is potentially the most fascinating story/question in Web3 right now. I agree whole heartedly with Crier. The gaming sector is positioned best to utilize this technology. He talked above about the exploit on the Harmony chain that DFK bore the brunt of. DFK’s Jewel token has been able to hold some of its value thanks to the creation of its own chain. The ability to create your own block chain at a fraction of the cost/time is an appealing proposition. Throw in the fact incentive programs such as the Avalanche Multiverse offer startup capital, many are looking hard at it. It should be noted, Cosmos seems to be having good success in this area as well. This is because I have no experience with it so I can’t offer an opinion right now.

I share Crier’s concern around impact on tokenomics. When $AVAX, $ETH etc. are not being used for the transaction fees, the underlying token (investment) is less appealing. In the creation of the subnet a large chunk of the original token gets burned. Very little information exists (or at least I couldn’t find it) on if there will be an ongoing token burn of the host blockchain’s token behind the scenes. This to me will be a critical factor moving forward.

I will be eagerly watching to see which gaming companies follow suit and opt to create the own chain using a subnet. Could this be Yuga lab’s plan with $APE? Could a large firm like EA go down this path?

Personal Investing Strategy

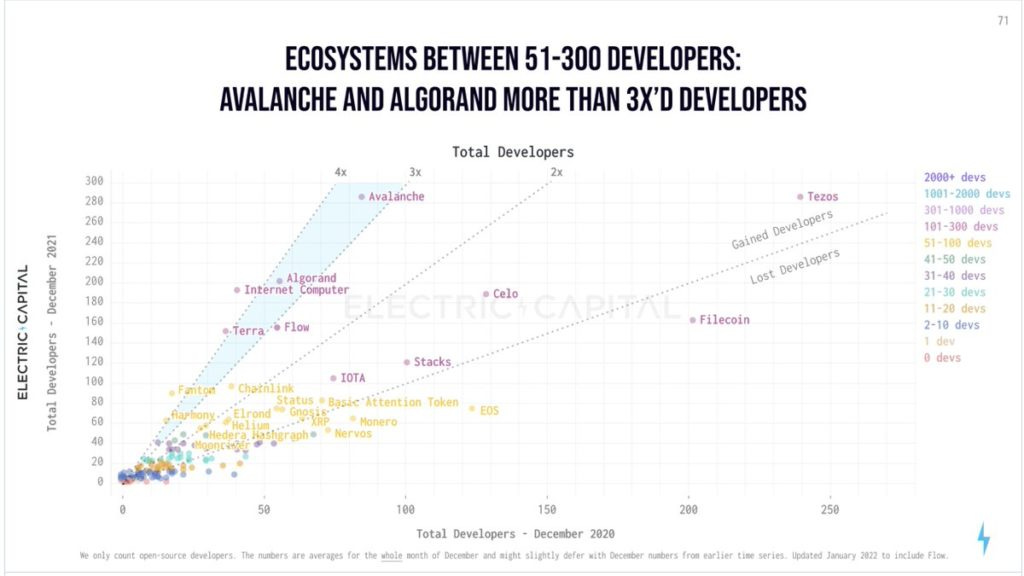

Canuck: I like to think of web3 in similar terms to the App store created in 2007. I firmly believe chains that are able to attract the most developer talent will be the ones who reign supreme. I did a deeper dive into this by exploring Avalanche’s strategy. Thanks to the research done by Electric Capital, we can see where developers have been flocking.

I believe, similar to other periods of history where we have experienced rapid advancements in technology, the number of key players will dwindle down to a few market leaders. The tech boom of the 90s had a plethora of startups and would-be market leaders. This has ultimately resulted in 4 practical monopolies today of Amazon, Alphabet (Google), Meta (Facebook), and Apple.

I am therefore putting my DCA $$$ into the chains I feel are winning the battle for developer talent. AVAX and Eth are my biggest bets, followed by ADA and Harmony (yes, I still believe). I doubt all 4 (or even 3 of 4) will ultimately survive, so I prefer to spread my investment around. I will also continue to monitor developer movement and alter my strategy accordingly.

Crier- I have chosen to go a different route than Canuck. I invest deeper into Ethereum and scaling or DeFi tokens. I think they have a longer-term outlook with the success of Multiple chains. Matic, Maker, Curve, Uniswap, Sushi, and Alchemix are tokens I have invested in. Most of these are functioning on a multi-chain level. I feel similar thoughts as Canuck, only a few of these competing layer 1’s will succeed. Many of the applications will be offered across multiple ecosystems. My focus is on the success of platforms choosing to build on multiple layer 1’s. This allows them to pivot regardless of who the dominant players are in the future.

Final Thoughts

The overall takeaway is that many different platforms are emerging to compete. Those that truly innovate or have the largest network effect will be a dominant chain in the future. Thousands of projects choose which Layer 1 chain they want to work with. They will then develop for their product’s future, a good indicator of which chains will survive.

During down trending markets, you see which chains are being developed on, even with the loss of incentivization. Each layer 1’s goal is to create a full ecosystem of cryptocurrencies, DeFi products, and thriving NFT scenes. They look to do this with the security and full uptime expected of blockchains. We aren’t there yet, but we are building the foundation for the future.

If you have any questions, please leave a comment, and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your own research on all financial endeavors. I hope these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without middlemen. Let’s build something together.

Tell your friends and family. This newsletter is targeting entry-level education for possible crypto investors. With more people understanding digital assets, we can finally progress to better. 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter, which includes my charting indicators for Trading View—for the price of taking me to lunch.