It’s all the rage. Non-Fungible Tokens, more commonly known as ‘NFTs.’ Do they offer value? Of course. Are they here to stay? Absolutely.

There are many sectors ripe for the picking, and the first one gaining traction is digital art. While I personally think the trend is borderline mania, it also solidifies the coming wave of digitalization. The conversion of everyday items into a digital version allows many sectors to advance record-keeping and digital storage methods.

The whole ecosystem began with the advancement of money. An algorithmically secured ledger that can hold all of the world’s wealth in zeros and ones. The resistance to the growth of this sector is fear of change and the loss of the status quo, but it will come eventually.

The beginning of programmable money was the smart contract that allowed this digital money to execute a contract without a middle man; the code allowed for a trustless system. Anyone could view the open-source code and decide if they wanted to interact within its ecosystem.

This led to the development of NFTs. The definition of fungible, in this sense, is the ability to trade one for another. 1 dollar is equal to any other 1 dollar bill. There is nothing different about its value to someone else. The same thing happened with digital assets. 1 ETH is always equal to 1 ETH. They are spent the same way. With NFTs, This is not the case. 1 NFT is not equal to another. It is the ability to create something that is digitally scarce.

Any collectible or “one-of-a-kind” item is not fungible. Before the internet, this was not a problem, but as technology advances, it becomes more difficult.

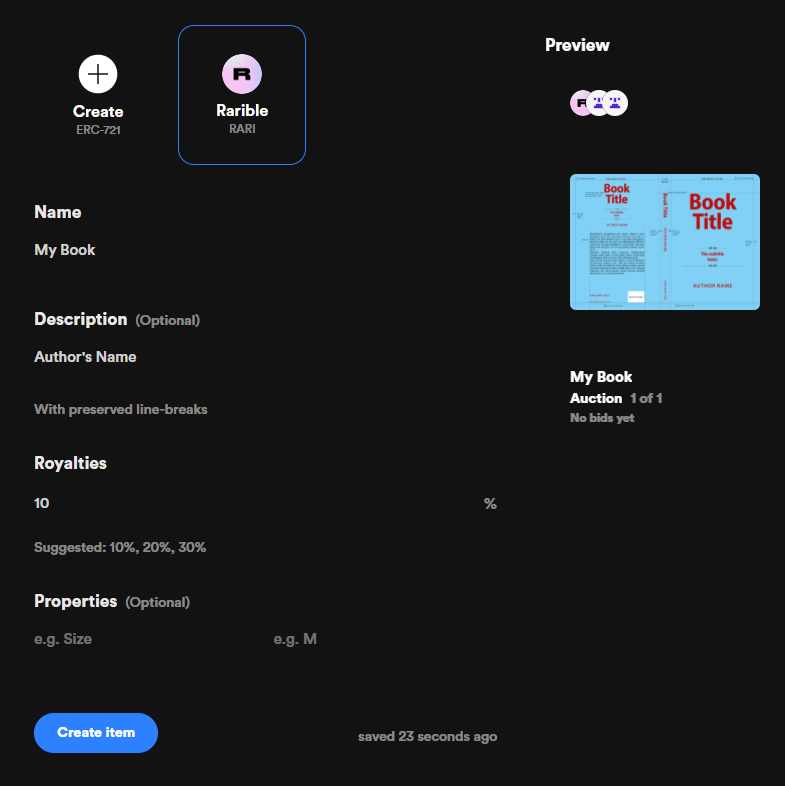

One sector that has a rampant issue with fungible items is e-books and digital writing. “I read this, and I think you would enjoy it; You should borrow my copy” can’t happen anymore. Currently, we have to purchase the book digitally on our e-reader, but an NFT version of the book would allow for the transfer of ownership and secondary book stores digitally. School books cost on average 1,298 dollars a year, and if you buy them digitally, you cannot sell them back. This is only beneficial to the publisher, who has substantially reduced the cost of publishing the book digitally. Another great aspect is you can build royalties directly into the NFT contract. Every time the book is sold, the author can generate a small portion of the profit. This protects the author from pirated versions of the book and greedy publishers who eat away up to 75% of their profits.

Another is the music industry. Agents and record labels collecting large sums of money from their artists, aka products. The music industry generates $43 billion in revenue, but only 12% goes to content artists. Also, these artists have minimal control over how their music is distributed and little visibility into the stream metrics.

This is becoming a sector that is filled with minimal reward to the actual content creator. Platforms are developing to combat this issue, such as Audius. By creating a community-led platform, end users can support the artists by allowing them to get a fair distribution of royalties and stream fees.

The use case of public record-keeping and legal document framework can also see many benefits from this sector. It can standardize contracts and allow for publicly stored validation for transparency. Lawyers can leverage blockchain technology to simplify their transactional work, digitally sign and immutably store legal agreements for their clients.DocuSign charges large fees for the ease of use of its platform, but similar standards for either public or private blockchain systems can provide similar products for a much cheaper rate.

While we are reaching market mania over NFTs, I believe that this trend is just the start of digitalization. As these platforms become easier to use and current blockchain limitations are outgrown, onboarding users will become exponential. Similar to social platform growth correlating to Metcalfe’s law, Blockchain growth will have its day in the spotlight.

News of the week:

Elon Musk: ‘You Can Now Buy a Tesla With Bitcoin’ 💎🤲

Tesla CEO Elon Musk announced today on Twitter, that the EV manufacturer has begun accepting payment for its range of electric cars in Bitcoin. A Bitcoin payment button has appeared on the Tesla website.

Notably, the Tesla chief executive added that it will hold any Bitcoin paid to the company rather than converting it to fiat currency; it will be added to the cryptocurrency reserves the carmaker already holds.

Earlier this year, Tesla bought $1.5 billion in Bitcoin. In its February SEC filing, the company said that it intended to accept payment in Bitcoin for its products, including its cars, in the near future. Tesla took just six weeks to fulfill its pledge. Read more.

Stablecoins in the Hot Seat: Powell Calls Bitcoin a Substitute for Gold While Fed Says Digital Dollar Prototype Coming in July 🤔

Three major moments over the last couple days help provide insight into the future of the U.S. government’s relationship with bitcoin, stablecoins and digital currencies.

The first was Federal Reserve Chair Jerome Powell’s comments on digital assets and a central bank digital currency, saying work on a U.S. “digital dollar” was not being motivated by bitcoin or any other crypto, and that bitcoin is just a gold substitute.

The second was news out of the Boston Fed that it would be showing off two digital dollar prototypes in conjunction with MIT by July.

The third was new draft Financial Action Task Force guidance around cryptocurrencies that CoinDesk warns are significantly more onerous than previous guidance. Listen here.

Deutsche Bank Says 52% of Its Investors Expect Bitcoin Below $60K in 12 Months 👀

Deutsche Bank’s investor clients mostly see limited upside in bitcoin (BTC) this year and expect a decline towards $20,000-$40,000 in twelve-months. Those are the highlights of a monthly market survey conducted by the German lender between March 18 and 22.

Bitcoin has been trading in a sideways range over the past week after failing to sustain an all-time-high around $61,000 reached earlier in the month. Read more.

Anti-Money Laundering Rules Targeting DeFi, NFTs Could Be Fatal, Analysts Warn ☠️

The Financial Action Task Force (FATF), a global anti-money laundering watchdog based in Paris, released draft guidance on Friday that, if adopted, poses an existential threat to the booming DeFi and NFT markets, analysts say.

In its new guidance, the FATF defined most operators of decentralized finance (DeFi) platforms as “Virtual Asset Service Providers” (VASPs). That means that, if the guidelines are adopted in the US and other major jurisdictions as proposed, many DeFi platforms will have to find a way to comply with rules around combating financial crimes. But that won't be as easy as it may sound. Read more.

Seems Gloomy out there? What do you think?

That’s all for the free weekly Crypto Crier. If you enjoyed this article, please like and share. If you have any questions, please leave a comment, and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your own research on all financial endeavors. I hope that these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without middlemen.

Let’s build something together.

Tell your friends and family. This newsletter is targeting entry-level education for possible crypto investors. With more people understanding digital assets, we can finally progress to better systems. 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter, which includes daily analysis of my top picks and setups for entry/exit positions—all of these extras for the price of taking me to lunch.