Proof of Work VS Proof of Stake

Consensus models for blockchain

This week we are continuing basic education for blockchain. If you missed previous topics related to this, you can find them here: 1,2.

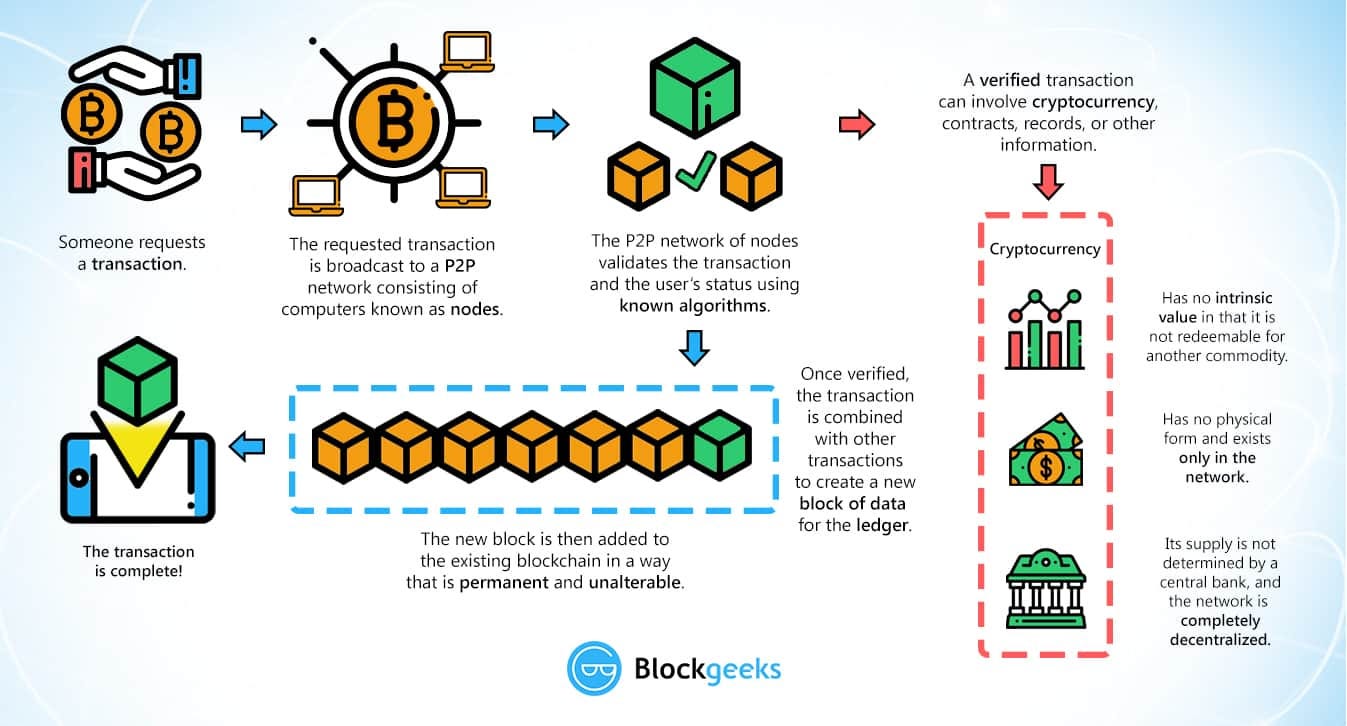

You want to send someone 100 dollars. While you click a few buttons, and away your transaction goes, a detailed orchestra allows that to happen behind the scenes. In the world of digital assets, this is called proof and is the most fundamental mechanism in all blockchain systems. It is a system to publicly prove that your transactions will be added to the ledger.

Before blockchain, you had to rely on two parties, your bank and the recipient’s bank, to give your hundred dollars to the intended person. Since this takes manpower and time, 3rd parties charge you fees. This is increasingly becoming more expensive as bank fees have risen exponentially over the last two decades.

How do we change this for the better?

Proof of Work

The hundred dollars you sent now is pooled with other transactions into an open block. These blocks or groups of transactions cannot be proven without someone doing work such as mining or voting consensus. This can happen in multiple ways, but proof of work was the original system that gave Bitcoin its’ ability to remove 3rd party providers from traditional finance.

This system uses energy as people are competing to solve the “work.” This work uses a computer to solve a mathematical equation, and upon completion, you receive the rewards and fees associated. The system is extremely hard to change or manipulate due to the competition between the miners. This prevents double-spending and is why there has never been a manipulation since blockchain’s inception in 2010. The biggest issue of this first proof system is the energy requirements. It is inefficient and uses the equivalent energy of Chile to keep it operating. This consensus model was the first, and as with all of civilization, we build on our previous advancements.

Proof of Stake

Born from the need to reduce this wasted energy, proof of stake models were created. This mechanism still solves blocks of transactions, but instead of doing “work,” all validators vote on the transactions. These voters take their cryptocurrency and lock them in a contract to provide an interest in the system. So that 100 dollars you sent is now voted on by millions of validators.

Economic finality is accomplished in PoS by requiring validators to submit deposits to participate and taking away their deposits if the protocol determines that they acted in some way that violates some set of rules (‘slashing conditions’). This mechanism disincentivizes exploits as you will be fined against your initial deposit for not following these conditions.

Another security measure is that your voting power is determined by the percentage of the total asset you own. An extremely large holder owning 3% of supply can only be rewarded 3% of the voting power, which reduces the potential for bad actors and becomes extremely costly if you try to manipulate the system. This proof allows for less cost and also more decentralization since the barriers for staking are much lower.

With proof of work, you had to purchase costly computers and run them at a loss since electricity is expensive, but with proof of stake, you have to own the associated cryptocurrency and allow it to be used for voting. This leads to a 96% reduction in energy costs with minimal loss of security and allows more transactions in a given time frame.

Progress is Always Forward

These systems are always evolving and will inevitably lead to more efficient and robust systems over time. Ethereum is in the process of converting its proof of work chain to proof of stake and with it comes a lot of safety checks so that no vulnerabilities can be exploited. These systems need to evolve to the rapidly changing landscape or become fossils. We are still in the infancy of these technologies and with it comes growing pains, but the future looks bright.

Choice gems happening in blockchain this week:

French Lawmaker Signs Petition to Allow Central Bank to Buy and Hold Bitcoin

A French parliament member has signed a petition to amend the laws to enable the central bank of France to buy and hold bitcoin as well as other cryptocurrencies. The petition urges lawmakers to urgently consider the matter, warning that not owning bitcoin will put France “in a financially weak position within 5-10 years.” Read more.

Reported volume of top South Korean crypto exchanges surpasses that of the country's stock market

The volume of transactions in the South Korean digital currency market briefly exceeded the daily average transaction amount of the country’s stock market on Sunday.

According to data from CoinMarketCap, the combined 24-hour volume of major South Korea-based crypto exchanges UPbit, Bithumb, Coinone, and Korbit was more than $14.6 billion on Sunday. On Friday, the same metric was roughly $14.5 billion on the Korea Composite Stock Price Index, or KOSPI, and $10 billion on the Korean Securities Dealers Automated Quotations, or KOSDAQ. Read more.

Bitcoin Makes Investing in Other Assets ‘Look Pointless’, Says Former Goldman Sachs Exec Raoul Pal

Macroeconomics expert and Real Vision co-founder Raoul Pal revealed he believes it’s pointless to invest in any asset class other than bitcoin and crypto as the flagship cryptocurrency has been outperforming everything.

While speaking to Ash Bennington on Real Vision Finance, Pal said that bitcoin is the only asset class that has been seeing legitimate long-term growth when compared to the Federal Reserve’s balance sheet growth. Per his words, dividing the S&P 500 index by the Federal Reserve’s balance sheet since 2008 includes the index in a specific range. Read more.

Grayscale Launches 5 New Trusts: Chainlink, BAT, MANA, FIL and LPT

The Wallstreet company of Grayscale Investments has announced the launch of 5 new digital asset trusts. Furthermore, the new trusts are now open for daily subscription by eligible individual and institutional accredited investors.

new trusts include:

Grayscale Basic Attention Token Trust

Grayscale Chainlink Trust

Grayscale Decentraland Trust

Grayscale Filecoin Trust

Grayscale Livepeer Trust

That’s all for the free weekly Crypto Crier. If you enjoyed this article please like and share. If you have any questions, please leave a comment and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your own research on all financial endeavors. I hope that these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without middlemen.

Let’s build something together.

Tell your friends and family. This is targeted at entry level education for possible crypto investors. With more people understanding digital assets we can finally progress to better . 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter which includes daily analysis of my top picks and setups for entry/exit positions. All of these extras for the price of taking me to lunch.