Quantitative Easing Policies’ effect on cryptocurrency growth

Quantitative easing, QE for short, is a government's central bank allocating purchases of government bonds and other private assets to free up the supply of liquid cash. This, in turn, reduces the lending rates to households and corporations to stimulate the economy through incentivized spending. QE has been a staple of global monetary supply amongst the world-leading economies with varied success since the ’00s. In 2008, the American mortgage crisis was ```seen as successful use of QE, as the economy recovered, but this widened the gap between the wealthy and poor citizens while contributing to the dying American middle class.

We think of most financial markets as separate; each government runs its central bank. This is happening globally; with most countries operating with a fiscal deficit, data appears normalized. I.e., all governments are doing poorly with economic stagnation.

While American expense has been roughly 33% of the GDP, Japan is spending 117% of its GDP. Over the last year and a half, the global stimulus has exploded to 9.1 trillion dollars in the hope of spurring markets rife with unemployment and stagnating spending in the service industries.

With the rising popularity of cryptocurrency, all citizens can store their wealth independent of these government monetary policies. Historically, people choosing this option benefit from it as it protects their wealth from inflation.

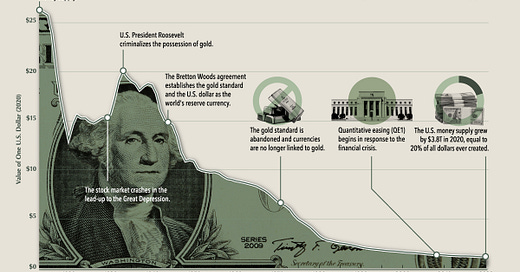

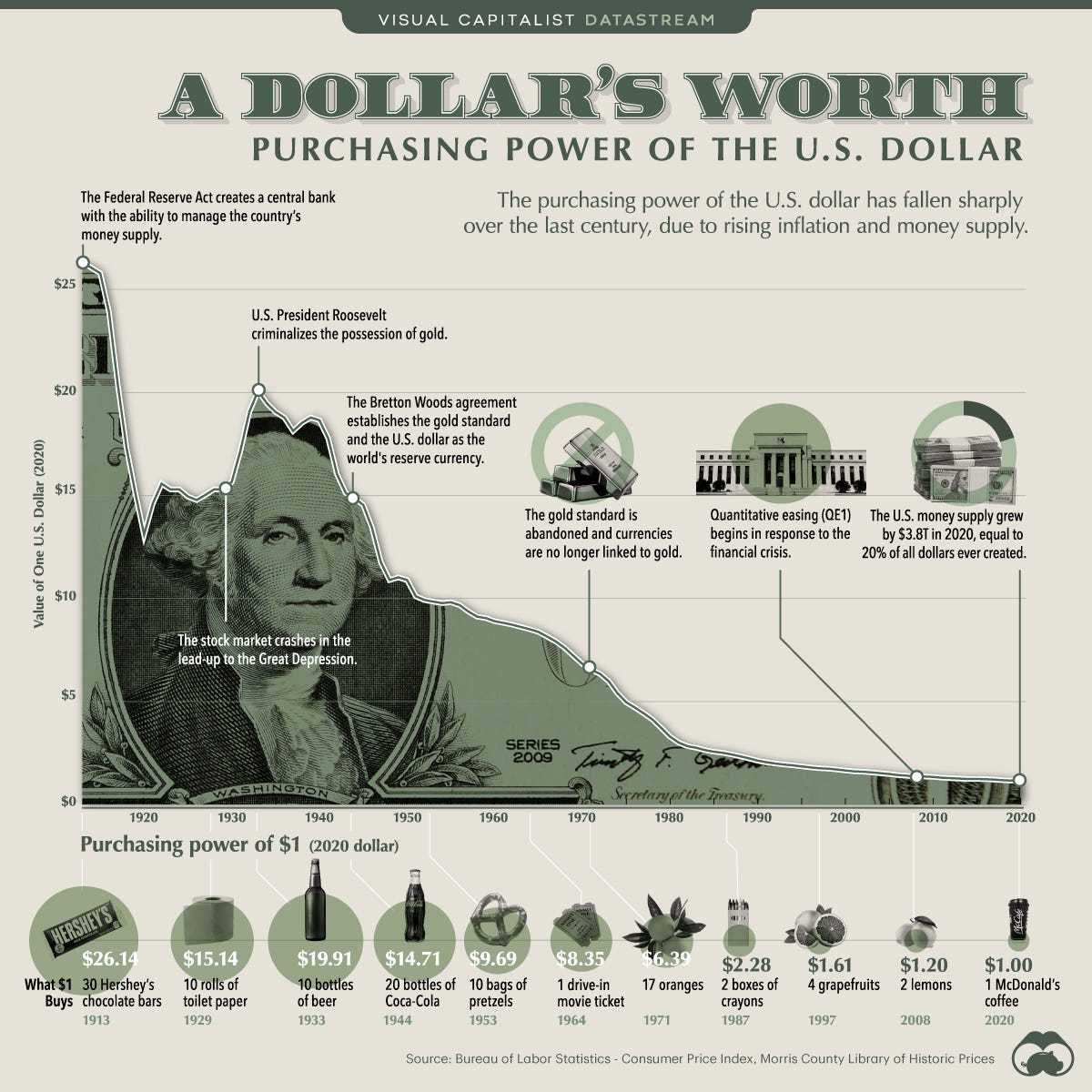

Compare the data. Cryptocurrency growth is on a different level. The global M2 supply increased 24.5T since 2014, causing the purchasing power of most fiat systems to dwindle. At the same time, the Digital asset market capitalization rose from 8 billion dollars to 2 trillion (a 250x increase) over those same 7 years. The future of cryptocurrency looks more enticing to investors as government operating deficits grow larger.

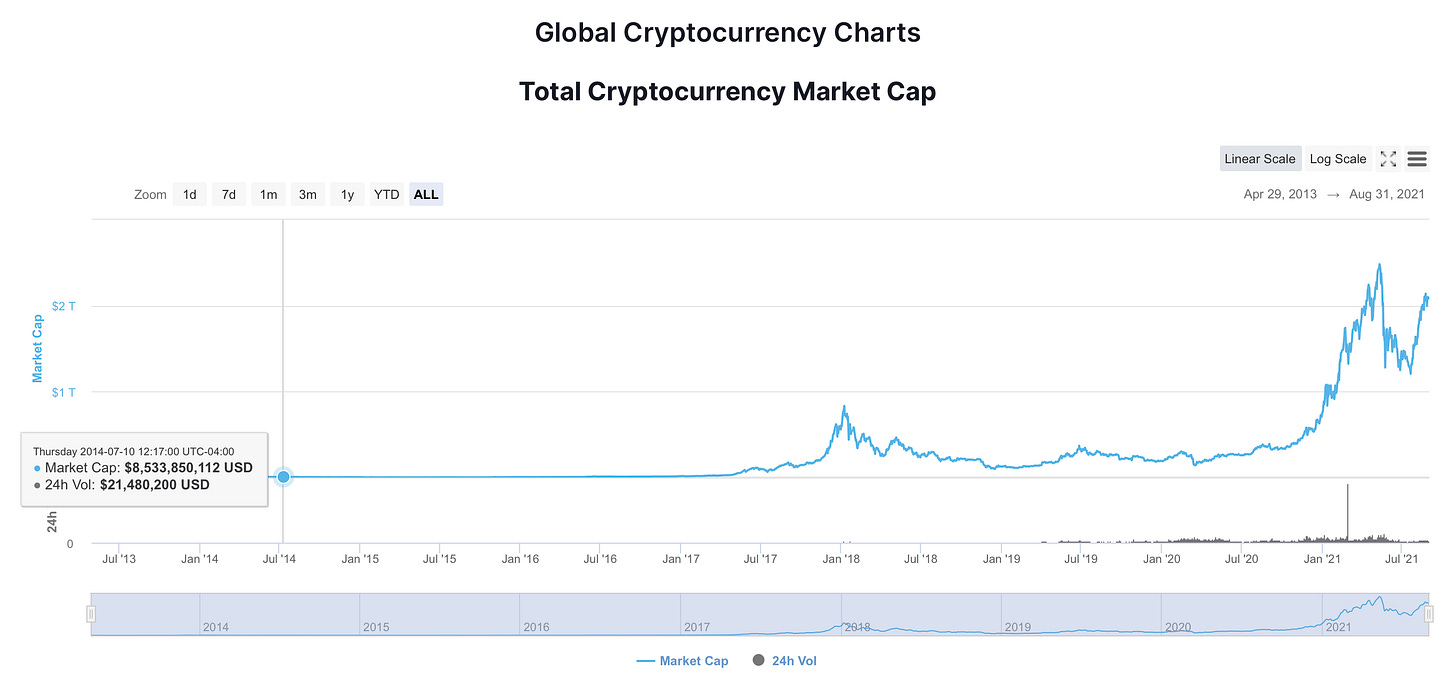

The data correlates to long-term holding being lower risk and higher reward.

As these governments continue to inflate their money artificially, I see little benefit to keeping your cash on the sidelines and in a bank. There are too many options to earn excellent yield without excessive risk, and I plan to continue on this path. So far, my strategy has done well for me, and I am sticking to it.