Switching to Layer-2: Polygon Rises to Dominance

Gas is expensive. Whether it is gas for your car or gas to use Ethereum, demand is currently very high. These prices have caused fledgling crypto participants to have problems interacting with the system. With this issue, the users are being priced out of Ethereum, causing them to move to other avenues for DeFi, such as Solana and Binance smart chain.

This war between chains has become a significant discussion point as users onboard to other platforms offering PoS (proof of stake) systems with less decentralization because of Ethereum’s growing pains. Many layer-2’s have been in development, but Polygon has been gaining the most traction.

Polygon is a PoS system that acts as a bridge between other blockchains. It uses a smart contract to hold your tokens and mints a polygon version of them. This system allows you to interact with the layer-2 version of your favorite Ethereum DeFi apps, with many planning to release this quarter. The entry into the PoS system takes minutes, but for security purposes exiting the bridge takes 3 hours to verify all transactions before minting your layer-1 assets.

The system is not as decentralized as Ethereum, as the validator nodes are mostly large exchanges, but the growth has been rapid. As more projects deploy onto Polygon, this will further decentralize the nodes. With all the background out of the way, Let’s see it in action.

How to onboard Ethereum to the Polygon PoS layer-2

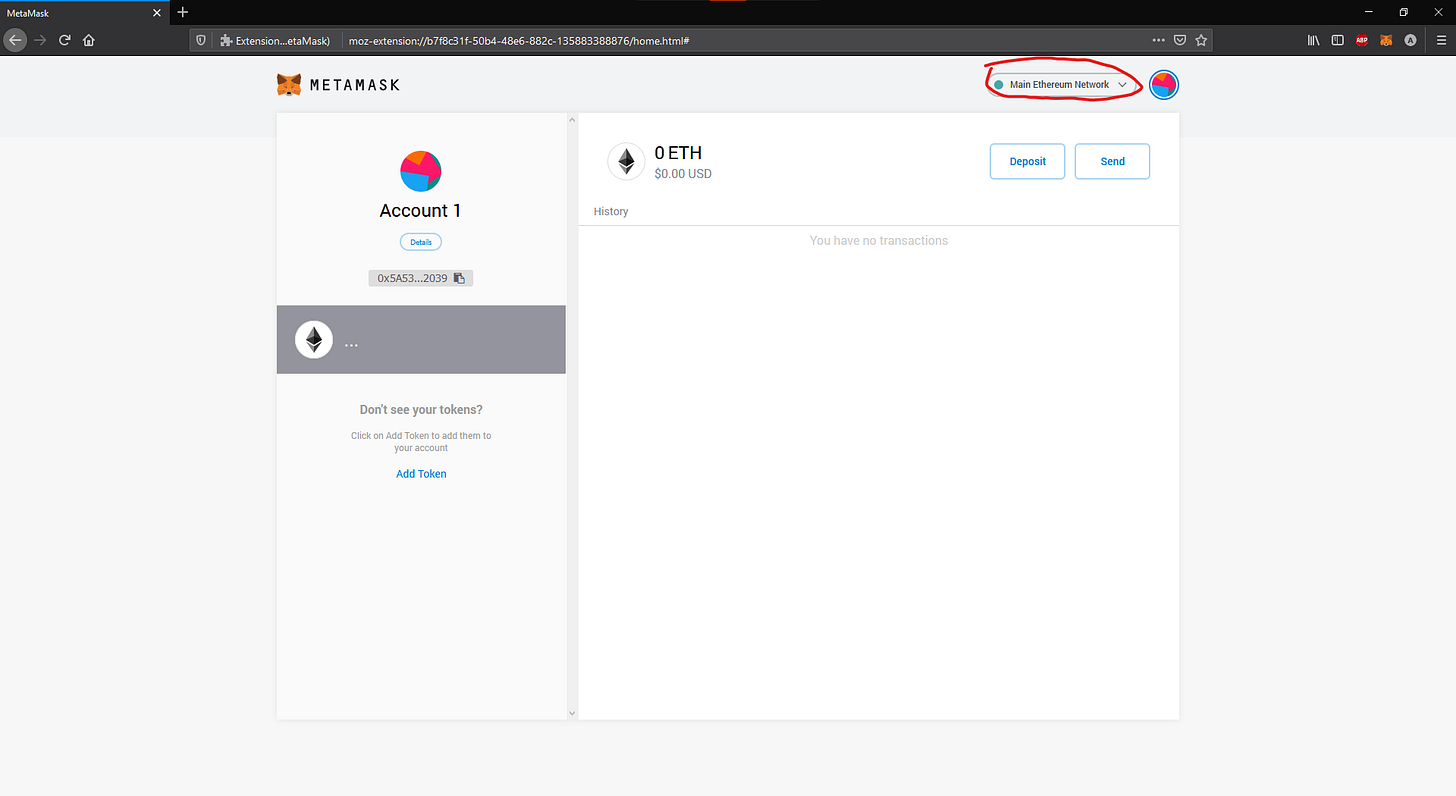

Download Metamask from here if you don’t have it already. Metamask is an Ethereum wallet with easy-to-use browser functions. If you already have a ledger or Trezor hard wallet, they integrate easily.

Once you finish creating your account (make sure to securely save your seed phrase or print out a hard copy), we need to switch to the polygon network by clicking the circled icon, select custom RPC.

Copy the following information:

You now have an account on the Polygon PoS chain. If you are using a hardware wallet, you can now use the bridge. If you are not, send Ethereum to your new wallet address and wait for funds to confirm.

Next, we access the bridge to Polygon here. Choose the amount you want to send. It would be wise to send a small amount for trading and think of layer-2 as a trading account. The initial deposit fees were $21.50 in gas, but check gas info for sending on lower demand timeframe to save on gas costs (Currently, it is $100).

After transferring to Polygon, you need gas to make transfers. Head to here for a polygon faucet. This site gives you .001 matic, which will be more than enough to make multiple transactions.

At this point, We are ready to enjoy Polygon.

Sushiswap, Quickswap, or Dfyn are currently the leading exchanges on Polygon. Once you see what assets you want to exchange, select Approve ETH, each traded asset has to be approved for trading once in your Polygon wallet, just like on the Ethereum mainnet.

DEXs are among the cheapest DeFi protocols to use; they are still not suitable for small trades. At current gas prices, trading on any mainnet exchange costs around $30-80+, and the cost to provide liquidity to these protocols is usually over $100.

The cost of a swap and to provide liquidity are both $0.0002, meaning that it is 43,500,000% cheaper to trade and 7,8500,000% cheaper to initiate an LP position on Polygon than it is on Ethereum mainnet. Just a tad bit more affordable.

AAVE variable lending- You can view all lending options by clicking the polygon lending pools shown below. Again gas is ridiculously low, so providing small amounts can be worth participating in the bonus Matic yield, shown below the deposit APY.

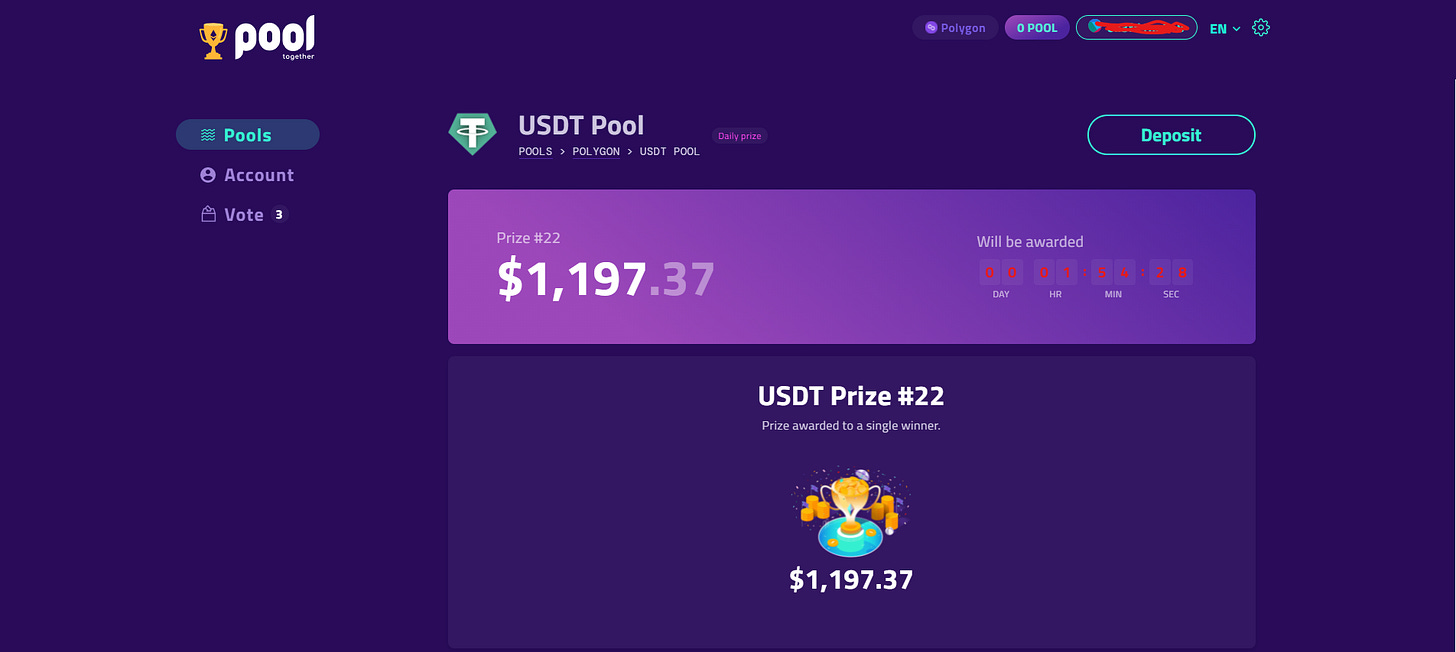

One activity I was always priced out of was the crypto lottery. PoolTogether offers a no-loss lottery that accrues interest over a week, and the winner receives the total interest collected. In the end, everyone receives their deposit back. This last week only had 1,100 participants, so odds are a lot better than Ethereum mainnet.

These are just a few of the fun things you can access through Polygon. It makes transacting on Ethereum a joy again instead of the exorbitant gas fees around every corner. Experience Ethereum properly; a secure base layer with a secondary layer to have high throughput.

The 3rd bloodbath of the bull run commenced this week. The recovery will be roughly a month of consolidation, similar to September 2020 and March 2021.

To the News!

Podcast of the week: The Age of Monetary Transformation, Feat. Bruno Macaes and Tomicah Tillemann

As a prelude, we invited Bruno Macaes, a Portuguese politician, author, and influential thinker on geopolitical trends and Tomicah Tillemann, the Director of the Digital Impact and Governance Initiative at the New America think tank, to give us their take on these matters. Some of the scenarios we discussed are challenging. They paint a picture of the mass disruption of the global economic order. But both our guests had a somewhat contrarian take to a common view, held by many observers of geopolitical trends, that forces of technological change and economic stress will conspire to bring to an end to the era of U.S. financial, economic and political hegemony. In different ways, Macaes and Tillemann both argued that the U.S., if it plays its cards right, could turn this current moment of economic uncertainty to its advantage and sustain the leadership of the global economy. To do so, they said, it must embrace the principles of open systems and open society that lie at the heart of the crypto ethos – and which, in theory at least, are ingrained in what is widely considered “American values.”

Crypto Market in Freefall: Bitcoin Falls 30%, Ethereum Falls 38%

The cryptocurrency market has continued its week-long plummet, with leaders Bitcoin and Ethereum falling through key supports on Wednesday.

Bitcoin plummeted to lows of around $32,100, a drop of 30% over the past 24 hours. Likewise, Ethereum plunged 40% to $2,059. Both cryptocurrencies have recovered somewhat, to prices of $35,368 and $2,489, respectively. Read More.

Ethereum Foundation: ETH 2.0 Will Use 99.95% Less Energy

Ethereum’s upcoming ETH 2.0 upgrade could help reduce the blockchain’s energy consumption and will no longer devour “a country's worth of power,” according to Carl Beekhuizen, a researcher at the Ethereum Foundation.

“By my (very conservative) calculations, Ethereum will see a greater than ~99.95% reduction in energy use post-merge,” Beekhuizen wrote in a research report published yesterday. Read more.

Bitcoin ‘Greener Than Petrodollar’: Human Rights and Energy Analysts

Bitcoin is more environmentally friendly than the petrodollar, according to Alex Gladstein, chief strategy officer at the Human Rights Foundation, and James McGinniss, CEO, and co-founder of David Energy. Both individuals appeared on the Unchained Podcast with Laura Shin earlier today.

The discussion took place against the backdrop of Tesla CEO Elon Musk’s shocking u-turn on Bitcoin. Three months after overseeing Tesla’s $1.5 billion investment into Bitcoin, Musk announced that the company would no longer accept BTC as a form of payment due to concerns about its climate impact. Read more.

That’s all for the free weekly Crypto Crier. If you enjoyed this article, please like and share. If you have any questions, please leave a comment, and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your own research on all financial endeavors. I hope that these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without middlemen.

Let’s build something together.

Tell your friends and family. This newsletter is targeting entry-level education for possible crypto investors. With more people understanding digital assets, we can finally progress to better. 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter, which includes daily analysis of my top picks and setups for entry/exit positions—all of these extras for the price of taking me to lunch.