The Flipper of JPEGS

Yeah, folks, I’m talking NFTs again. Do you want to know why? Because it’s the most profitable scene in crypto, and we’re early. So jump on board the train or get ready to wave as we pass by. 🚂👋

NFTs will slowly consume media content as we know it over the next few years, and people who are figuring out the concepts now will have a GOOD TIME. One of the questions I get often is how do you know when to sell an NFT; is it something for a long-term hold, or is this project a pump and dump? The best answer is who the hell knows.

BUT, having the most accurate set of tools can help you on your way and set you apart from the pack.

To Mint or Not To Mint

It’s a gamble. Minting is the most lucrative process in NFTs but can lead to severe losses if a project doesn’t do well. It’s like investing in seed funding rounds in a company, immense reward potential, and considerable risk. With all of the projects releasing daily, the market is becoming saturated with non-performing projects just looking to make a quick buck.

The best tip I have for this is learning your way around smart contracts. I will use the Apes of Space contract for this example since I found a discrepancy and decided against minting as they lied about the total supply. In the Discord, they told everyone there were 6,371 total mints, and they chose this number because it was the earth’s radius.

Well, a simple glance at the contract showed that this was not true. The devs said it was for marketing purposes, and they would reveal more info about the increased 30% supply after, but this type of behavior in a burgeoning market is unacceptable. This is why investors need to research. Take some time and go to the contracts of your projects and see what you can find. If you are unsure how to find the contract, ask a mod or developer in your project’s discord channel.

NFTs are Illiquid

NFTs are hard to sell when there is low volume. Art is subjective, and new investors are fearful. One of the key metrics that I look for on NFTs is 2hr and 12 hr volume. It is always better to catch the upward trend with NFT volume and sell at a fair price than to try to catch it on the downward movement; people get fearful and pile in a sell cascade. For example, most projects were pumping right out of the gate with little rest periods after large upward movements in August. Everything would sell within minutes of listing near the floor price, then NFT downtrend began (3 weeks), and volume died even with top-tier projects.

Icy.tools is one of the best platforms for tracking project volumes and sales. They have a lot to offer, even for their free plan, and if you are new to NFTs, it is a great place to start. The premium version is a .2 eth lifetime membership, and I think it is worth it since it provides vital data. Another on-chain data platform is Nansen.ai, but with Nansen, you have to fork over the big bucks($1400 a year), and it is more comprehensive, including crypto trading.

Mint From the Contract

Minting from the website is the easiest way, but sometimes, the website can go down with a lot of traffic. Along the same lines as making sure you read the contract, being able to mint from the contract is also essential to give you an edge.

You will need the following four things:

1️⃣ ETH in your wallet to cover mint price + gas price.

2️⃣ The verified contract address can usually be found before launch on the website or Discord.

3️⃣ The price per token, in this case, .1 ETH

4️⃣ Know the maximum number of tokens able to be minted in one transaction. For Nah Fungible Bones, ten was the max.

After getting the contract, make your way to Etherscan and paste the contract address in the address search. For this example I’m using the Nah Fungibles Bones contract: 0x0Ee24c748445Fb48028a74b0ccb6b46d7D3e3b33

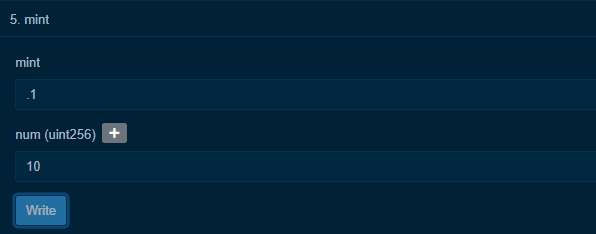

Once you are on the contract tab, find the ‘write contract’ button. Connect your Metamask to Etherscan to allow the tx to be sent. For this example, Nah Fungible Bones minted at .1 ETH and had a max of 10 per TX. Fill in the contract and press ‘write.’

Selecting the proper gas is critical as not having enough will revert your transaction if the project fully mints quickly. If the project moves insanely fast, it may be worth looking at secondary sales. Especially if you’re a rookie and you don’t have much capital to risk.

These are just a few tips that can help NFT beginners make the most of their time and hopefully not get caught in a cash grab. Happy jpeg hunting, everyone. Be smart. Stay safe. Have fun.

If you have any questions, leave a comment below.