Titans above 1 Trillion

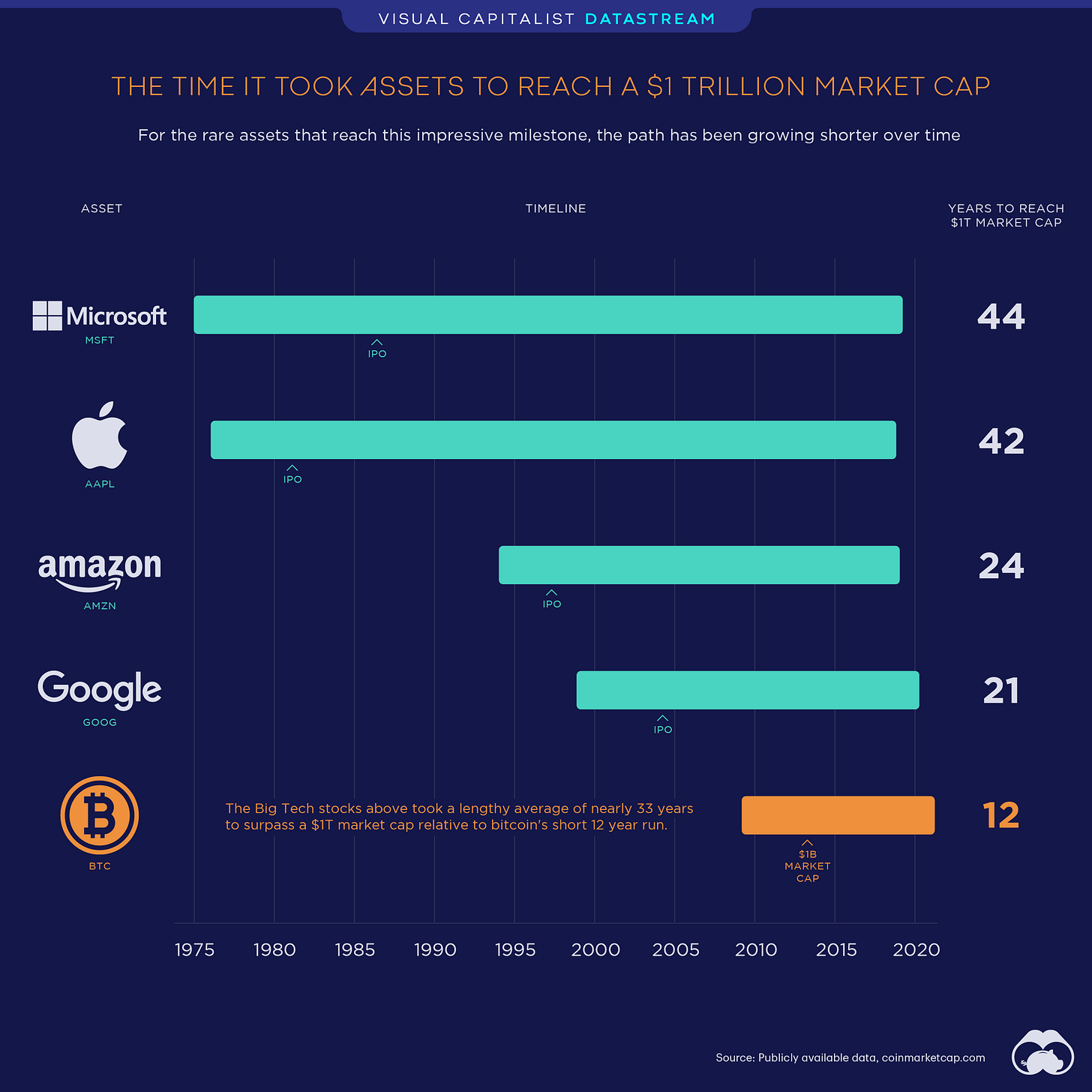

The road to a 1 trillion dollar asset is a long, arduous journey for some. For others, the growth happened relatively quickly. The purpose of this article is to talk about the half-trillion-dollar asset called Ethereum and how it will rise to 1 trillion faster than them all.

To show the similarities between the meteoric rise in cryptocurrencies, let’s compare Ethereum and Bitcoin.

It has taken 12 years for bitcoin to join the four comma club. According to renowned on-chain analyst Willy Woo, Bitcoin’s price above 5The support at this price range above 1 trillion is growing to levels last seen at the 6,000 to 11,000 USD range.

While this support has been building since February, the most exciting part about the meteoric rise to 1 trillion market capitalization is how long it took. December 28th, 2020 was the first time Bitcoin passed the 500 billion USD mark. 54 days later, Bitcoin doubled. Multiple metrics pointed to this build-up. The growth of new addresses and Q1 institutional investing reached new highs.

Now, let’s compare Ethereum. Ethereum has been building support below the 500 billion market cap.

The growth of new addresses is increasing rapidly; daily transactions and miner revenue have been consistently higher than BTC. The velocity of network growth also has dramatically progressed since the Toronto stock exchange (TSX) added Ethereum ETFs on April 20th, 2021. Ethereum was priced at 2,178 USD on this date and less than three weeks later is up 96%.

Ethereum may continue this trend as Van Eck is looking for approval of the New York stock exchange (NYSE) Ethereum ETF application. The NYSE currently has a 22.1T market cap compared to TSX’s 2.3T total market cap. There is the possibility of 10 times the exposure on the NYSE if there is a similar market attraction as the Canadian ETFs.

An ETF approval for the NYSE will also place a lot of strain on the already dwindling supply of free ETH. The percentage of Ethereum's supply that can be traded is at a 2 year low. The increase in the utilization of smart contracts has captured 22.8% of the total supply.

With most on-chain metrics showing rapid growth and the free supply of Ethereum dwindling, Pressure on the price will continue to rise. Another factor comes into play in July with an Ethereum upgrade that addresses the exorbitant gas fees. EIP 1559 changes the gas fees structure to have a given base fee and not a variable pay scale to reduce overpayment of gas fees. According to the proposal, most Ethereum users are overpaying transaction costs by 33%. This upgrade will allow for periods of transactional demand to slowly increase gas costs based on the percentage of a full block.

While retail is still the primary consumer for Ethereum, multiple growth sectors such as DeFi, NFTs, and DAOs reveal Ethereum’s strength and will begin to capture more institutional onboarding. With many of these indicators, the velocity of growth on Ethereum is more significant than Bitcoin in every aspect.

Due to these metrics and proposed upgrade EIP 1559 to Ethereum slated for July, I believe in less than 54 days after breaking through the 500 Billion dollar market capitalization, Ethereum will reach 1 Trillion.

Why do it in 12 years when you can do it in 8?

This week is shaping up to have lots of positive institutional interest on the horizon.

Ethereum Options Trade Volume Exceeds Bitcoin’s, Deribit Introduces a $50K ETH Strike for 2022

Last week, Ethereum options volume surpassed bitcoin’s for the first time on the digital currency derivatives exchange Deribit. Further, the trading platform recently introduced a $50k ETH strike for March 2022 and explained the $50k call is “gaining immediate buy traction.”

When it comes to bitcoin (BTC) derivatives, the trading platform Deribit captures the lion’s share of today’s options volume. The cryptocurrency exchange also features bitcoin futures and ethereum options as well. During the first week of May, Deribit’s Ethereum (ETH) options surpassed bitcoin (BTC) options for the first time. Read more.

First Crypto ETF Just Launched in the U.S.

The very first exchange-traded fund with the word "crypto" in its name has been launched in the U.S. by $1.5 billion digital asset fund manager Bitwise, the company announced in its May 12 press release.

The ETF, which is called "Crypto Industry Innovators 30 Index," will offer exposure to publicly listed cryptocurrency companies such as leading U.S. exchange Coinbase. Read more.

DeFi lending platform Aave reveals 'permissioned pool' for institutions

The banks are out of the bag: In a Tweet on Wednesday, Stani Kulechov, co-founder of decentralized finance money market protocol Aave, revealed that the Aave protocol has built a “private pool” for institutions to “practice” before getting involved with the DeFi ecosystem.

Earlier on Wednesday, a Twitter user posted an angry tweet directed at Aave’s official Twitter account, noting that his address had been “blacklisted” due to Anti-Money Laundering requirements.

Kulechov himself responded to the tweet, saying first that there had been a mistake and that “The text is actually incorrect and relates to another pool we're testing out,” before later revealing the clientele the pool was designed for institutions.

In an interview with Cointelegraph, Aave’s head of institutional business development, Ajit Tripathi, confirmed that the protocol had designed a permissioned pool — the "private pool" description in Kulechov's Tweet was a misnomer in that the pool will be on public chains, but have permissioned access — specifically for institutions. He characterized the purpose of the pool as educational. Read more.

That’s all for the free weekly Crypto Crier. If you enjoyed this article, please like and share. If you have any questions, please leave a comment, and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your own research on all financial endeavors. I hope that these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without intermediaries.

Let’s build something together.

Tell your friends and family. This is targeted at entry-level education for possible crypto investors. With more people understanding digital assets, we can finally progress to better. 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter, which includes daily analysis of my top picks and setups for entry/exit positions—all of these extras for the price of taking me to lunch.