Why I Sold My Axies for DeFi Kingdoms

So, I have become a DeFi Kingdoms maxi. It aligns with my medieval theme for the newsletter, and apparently, it was destined to be. To me, all jokes aside, there has not been a better long-term play in a while. If you haven’t heard about DeFi Kingdoms, check out this article below.

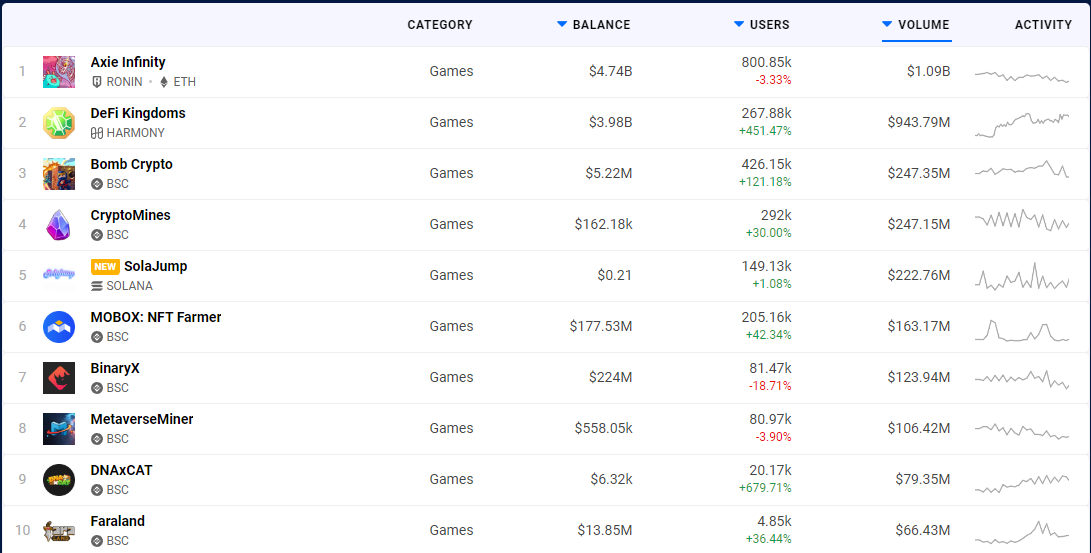

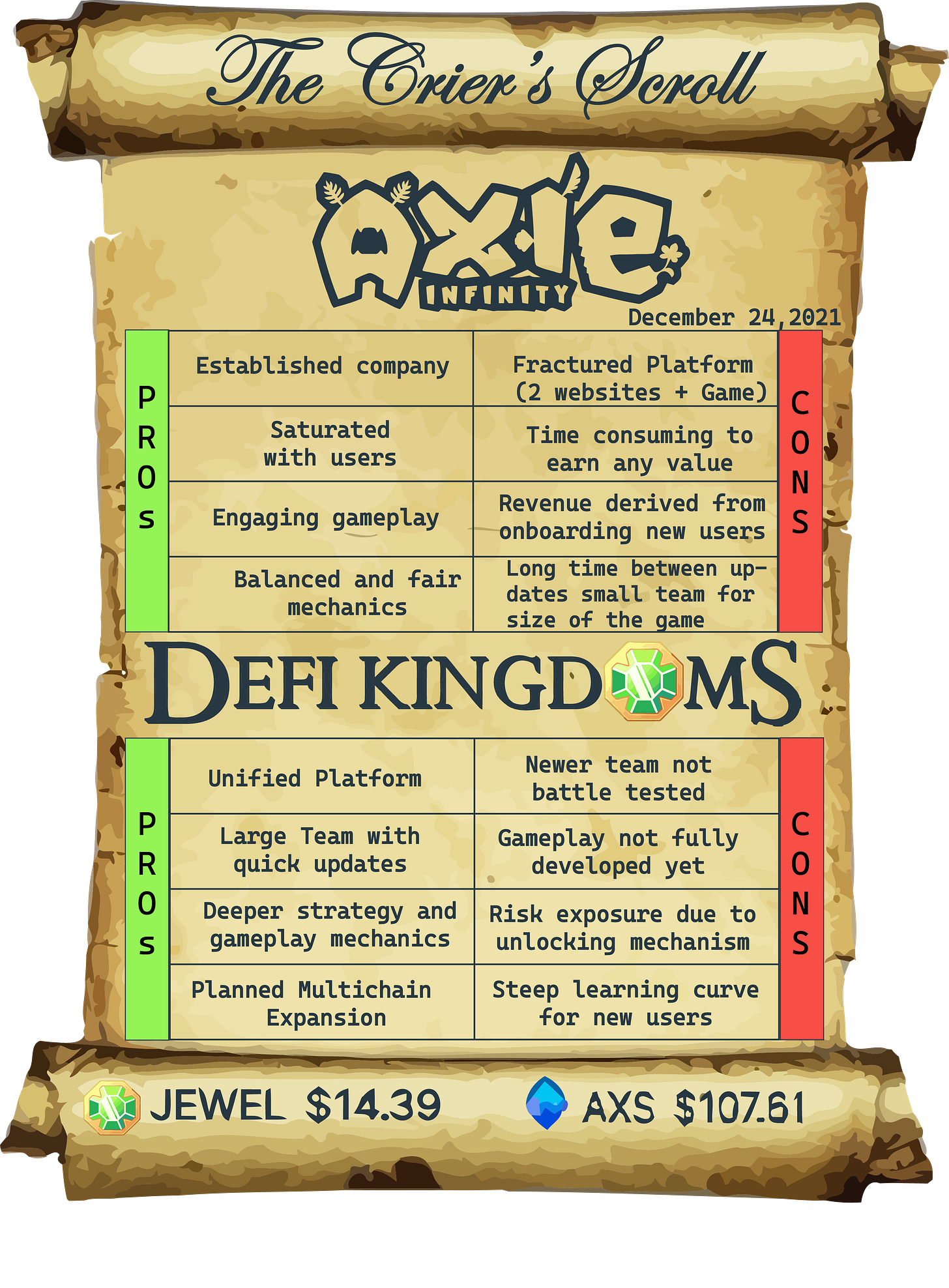

Over the past month, I have been highly involved in Defi Kingdoms, and for a good reason. The depth behind this game does take quite a bit of research to understand, but as you continue down the rabbit hole, you can see how much value it truly has. For this article, I will compare tokenomics and growth with Axie Infinity, the pinnacle of blockchain pay-to-earn games for the past few years.

To start, I have been an on-and-off Axie player since 2018. I was there before the PVE and PVP aspect, which is very similar to where we currently are with DeFi Kingdoms. At the time, summoning was the only action you could do, and Sky Mavis, the game studio behind Axie Infinity, added new things over time.

Due to the psychology of gaming, these new updates add value and make people want to hold their assets in the system. I can explain this with one of the newer profit gaming models, the free-to-play game. Free-to-play games give you free tokens and make the starting levels easy to beat. As the game progresses and people get rewarded, their enjoyment increases. Once the game becomes a habit of playing, it continues to get more complicated, and the player is then given a choice of paying for tokens that enrich gameplay or having to wait. This has become the new profit model for many games because of the impatience of players and the need for rewards.

Play-to-earn games do not have this but instead flip this mechanism on its’ head. Play-to-earn games typically require you to make an initial upfront investment into the game to play. Once your in-game assets have been purchased, you are the owner, not the game studio.

With most games, trapping value inside by having no exit ramp for your in-game assets is a way to ensure they capture 100% of the profits. Electronic Arts and Blizzard have become serious offenders in modeling their games for maximum profit and weaker gameplay over the years. With Ethereum and other blockchain assets, transferring between platforms has become extremely easy. Here is where NFT or blockchain-based gaming assets shine. You can sell your time spent to other players instead of leaving them on your account. This is the value of play to earn games; the developer profit is also lucrative to players.

Continual rewards and game updates will keep people involved at a higher level. While early investors take profit, they may do so less than average because of the chance of high returns being locked into the game/NFT aspect of the platform. As mass adoption comes along, specifically the gamification of DeFi and making DeFi easier to use, early users will be less inclined to take profits, and newcomers, while small in purchasing power individually, will grow at an exponential rate. As the tokens get unlocked from the locking mechanism in July of 2022, the likelihood that these Jewel tokens will reenter the ecosystem between staking, farming, and utility of heroes is higher, leading to low sell volume, high buy volume. This opinion is founded on DeFi Kingdom’s unlocking period is structured to reward long-term users.

Well, this is what Axie Infinity did and has done this for years?

Yes, they have.

Over the years that Axie Infinity has been in development, there were very few users until released gameplay. Just with any game, development takes a substantial amount of time. This development usually releases alpha and beta for years with traditional studio games to a minimal user base. With Blockchain game development, users play early and take risks similar to venture capitalists. They are rewarded with early assets that may or may not be successful. With higher risk, usually greater long-term reward possibilities arise.

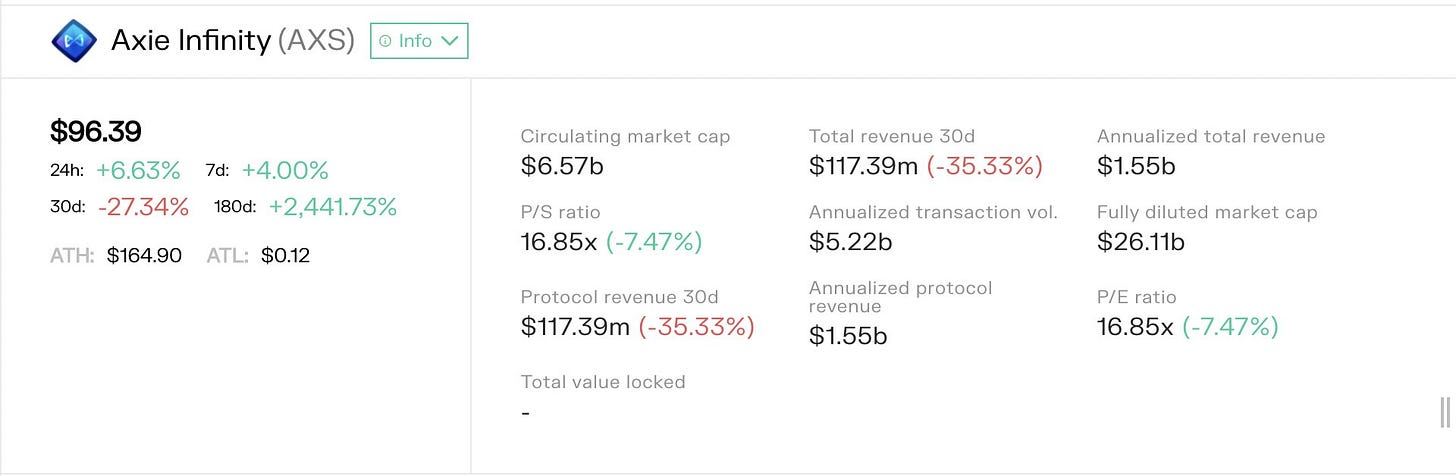

This has paid off tremendously for Axie Infinity and Sky Mavis. Axie Infinity overtook behemoths in the video game industry such as Take-Two Interactive, Zynga, and Ubisoft. Axie Infinity is now valued at a staggering $30 billion by market capitalization. This propels it to the number five spot, only behind other multi-billion dollar industries like Activision Blizzard, Nintendo, Roblox, and Electronic Arts.

That is why I believe DeFi Kingdoms will do so well in the long run. With better mechanics and a strong team delivering very engaging content rapidly. Only time will tell, but growth is just a matter of time from what I have seen.

That’s all for the free weekly Crypto Crier. If you enjoyed this article, please like and share. If you have any questions, please leave a comment, and I can answer your questions further. As with all of my writing, this is not financial advice and is my opinion. I cannot stress enough how important it is to do your research on all financial endeavors. This is not meant to be construed as financial advice. I hope that these newsletters can help investors realize the current financial systems’ downfalls and usher in a more equitable system without middlemen.

Let’s build something together.

Tell your friends and family. This newsletter is targeting entry-level education for possible crypto investors. With more people understanding digital assets, we can finally progress to better. 🗣️

If you enjoyed this article, please consider subscribing to my paid newsletter, which includes my charting indicators for Trading View—for the price of taking me to lunch.